Nobody likes thinking about taxes, including electric car owners. Nevertheless, the electric car tax is something all EV owners should know their way around, even those of you living in the United Kingdom.

More and more electric cars are driving on UK’s roads. Over 840,000 plug-in vehicles have been registered in the UK since March 2022. That number includes 460,000 battery-powered electric vehicles (BEVs). It also includes 380,000 plug-in hybrids (PHEVs).

Looking at those numbers, it’s easy to see why those living in the United Kingdom need to know their way around electric car tax.

Spoiler alert: there is no road tax for BEVs in the United Kingdom! However, you still need to understand that road tax in the United Kingdom applies to BEV or PHEV owners.

In this article, we look at current tax incentives and grant news for electric cars; this is all happening now in the United Kingdom, so read on!

Table of Contents

What Is Road Tax In The United Kingdom?

Road tax in the UK is like road tax anywhere in the world; it’s a tax levied by the government on vehicles using the road. The taxes collected go toward the development and maintenance of road infrastructure.

…in this world, nothing is certain except death and taxes.

Benjamin Franklin

How Does Road Tax In The United Kingdom Work?

Road tax in the United Kingdom is implemented in several ways. The government uses a number of mechanisms to levy taxes on road users. The most common is Vehicle Excise Tax and Hydrocarbon Oil Duty.

Vehicle Excise Tax

In the United Kingdom, road tax goes by the term Vehicle Excise Tax or VED. VED was a specific tax until 1937, after which it was classified as a general tax. Post-1937, it had to compete with other departments for funds.

Big changes came to road tax in 2005. At this time, VED fees were linked to the emission ratings of vehicles; since vehicles are classified into bands of CO2 ratings, those emitting more face steeper charges and vice versa.

This VED, combined with hydrocarbon oil duty (or simply fuel tax), accounts for roughly 7% of all tax income in the UK.

Hydrocarbon Oil Duty

Like VED, hydrocarbon oil duty or fuel tax is a tax levied on fuel that you use to fill up your vehicle at the gas station.

In the United Kingdom, busses that provide public transport services receive a fuel rebate. Additionally, Jet fuels for the aviation industry do not carry any taxes whatsoever.

Moreover, in the United Kingdom, hydrocarbon fuel duty is based on fuel volume bought instead of the percentage of the selling price.

Interestingly, in May 2018, some of the highest fuel taxes paid anywhere in Europe were in the UK.

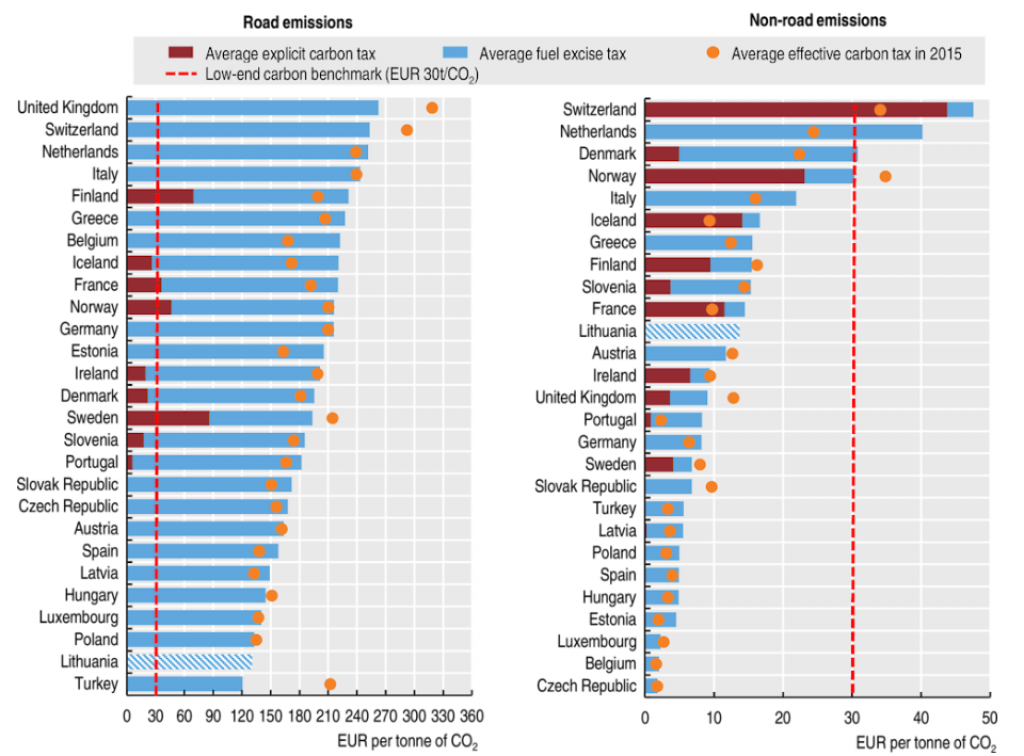

The United Kingdom still has some of the highest fuel taxes in Europe, as seen in the graph below. However, its average effective and explicit carbon tax falls somewhere in the middle of other European countries.

The UK has made significant strides toward carbon neutrality. One of the main sectors it’s trying to transform is the transportation sector. That includes you and your EV.

Electric Car Tax In The United Kingdom

But what does any of this have to do with electric car tax in the UK? You may ask.

Well, the way cars and electric cars are taxed in the UK changed in April of 2017.

Electric car users in the United Kingdom need to understand one fundamental point about EV road tax — vehicle road tax rates are based on CO2 emissions.

That means that it costs:

- £0 a year for vehicles with zero CO2 emissions;

- £155 a year for alternative fuel vehicles (hybrids, bioethanol, and LPG);

- £165 a year for petrol or diesel vehicles.

Additionally, there are C02 emissions that either raise or lower your road tax. We’ll discuss this shortly.

Do I Have To Pay Electric Car Tax In The United Kingdom?

The short answer is no. In truth, it depends on what kind of electric car you drive and whether it emits C02 while being driven.

There are two broad categories of EVs (Electric Vehicles) to consider when determining whether you have to pay road tax for your electric car in the United Kingdom:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Vehicles (PHEVs)

In the UK, you do not pay any road tax for BEVs because they do not emit CO2 when driving.

Let’s look at some other aspects of road tax and your electric vehicle to better understand the situation for PHEV owners.

Other Road Tax Components

Drivers registering their cars need to familiarize themselves with the following road tax elements:

1. Road Tax For New Cars

Annual road tax payments: cars with a sales price of over £40,000 pay £355 in surcharge fees every year for five years.

But what if you drive an electric car (BEV) in the United Kingdom? If you drive an electric car, this fee does not apply, regardless of the sales price. As such, you won’t be charged any annual fees!

What about a PHEV or hybrid car? If your PHEV emits CO2, you’ll be liable to pay an annual fee. The annual flat rate fee for PHEVs is currently £155. At least that’s £10 less than the standard £165 on traditional vehicles.

Additionally, PHEVs still pay according to their C02 emissions. The good news is that you’ll pay less as a PHEV driver on UK roads. You save money since CO2 emissions are usually lower than those of non-electric cars.

See the table below as a quick reference guide.

| Band | CO2 Emissions grams/km | BEV/PHEV Annual Rate (Tax Class 59) | CO2 Rate Petrol Car (Tax Class 48 & 49) |

|---|---|---|---|

| A | Up to 100g | £0 | £0 |

| B | 101 to 110g | £10 | £20 |

| C | 111 to 120g | £20 | £30 |

| D | 121 to 130g | £95 | £105 |

| E | 131 to 140g | £115 | £125 |

| F | 141 to 150g | £130 | £140 |

| G | 151 to 165g | £165 | £175 |

| H | 166 to 175g | £190 | £200 |

| I | 176 to 185g | £210 | £220 |

2. The Following Years

As stated above, BEVs pay nothing while PHEVs pay a reduced fee in accordance with their emissions.

Lastly, regular cars pay the most due to their emissions, which are higher than those of BEVs and PHEVs.

This is where you can apply the sliding scale of charges in the table above for cars registered after April 2017.

We compare BEVs, PHEVs, and regular cars for your reference next.

Comparison

Let’s take the Toyota Prius 1.8l Automatic VVT+i Business Edition Plus Auto as an example. The vehicle’s on-the-road rate (OTR) is £24,175, less than £40,000 and automatically excludes the £355 surcharge. We’ll compare this with a petrol car of similar value, like the Jeep Compass 1.6 Multi Jet II.

Let’s compare the road tax for this hybrid car with an electric car in the UK in the table below.

| Car Type | Band | Single 12-Month Payment | C02 Rate | Total Annual* |

|---|---|---|---|---|

| Any BEV | (A) 0g | £0 | £0 | £0 |

| Toyota Prius 1.8l Automatic | (B) 100-110g | £155 | £10 | £165 |

| Jeep Compass 1.6 Multi Jet II | (G) 151 -165g | £165 | £175 | £340 |

BEVs are crowned the winners! You won’t pay any road tax or C02 fees for registering and driving your BEV on UK roads! Since April 2020, you also do not have to pay any surcharge for BEVs with a sales price of over £40,000.

In second place are PHEVs. You’ll pay less road tax during registration and usually less in C02 fees. This, of course, depends on the CO2 band your car belongs to, as illustrated above.

Combustion engine cars come in last place; they emit the most CO2 per kilometer driven.

Please click here for governmental reference documents on EV and CO2-based road tax in the UK.

Are There Tax Incentives For Electric Cars In The United Kingdom?

Incentives did exist for consumer-facing plug-in cars in the UK, but as of 14 June 2022, they’ve been discontinued.

However, former incentives were responsible for leapfrogging UK’s plug-in car market to its current mature stage.

In fact, only 1000 plug-in cars were sold in the UK in 2011, compared to the 100,000 already sold in the first half of 2022.

Instead of providing further incentives for end consumers to buy BEVs and PHEVs, £300 million in funding is being redirected to wheelchair-accessible vehicles, vans and trucks, taxis, and motorcycles.

Additionally, the government is investing another £1.6 billion in EV charging infrastructure. There will be lots of places to charge your next EV!

What Grants Exist For Electric Cars In The UK?

Grants have been largely discontinued in the UK.

However, grants for low-emission vehicles, such as taxis, mopeds, and motorcycles, are available. There are specific requirements to fulfill to qualify for these. To learn more about them, please click here.

Final Thoughts

Many grants and incentives for electric car owners in the UK are gone.

Nonetheless, it’s one of the best times to be an electric car owner in the UK regarding road tax because zero emissions equal zero road tax.

Moreover, a significant road tax component depends on your vehicle’s CO2 emissions meaning that PHEV owners, who emit less, will enjoy this too.