Owning an Electric Vehicle (EV) has many upsides, including reduced carbon emissions and savings on unstable gas prices. But what about the responsibilities associated with owning an electric car in the U.S., particularly tax-wise?

EVs are becoming more affordable to purchase and to drive. You could even qualify for $7,500 in electric car tax credits in the United States. It’s no wonder why in the U.S. alone, 40% of respondents said they’d buy an EV in the next 5 years.

The tax credit on EVs in the U.S helps, but even without it, EVs have become 3 to 6 times cheaper to drive.

To clarify, EVs don’t require fossil fuels to run, meaning they contribute less toward tax revenues levied on fuel in the United States. So, does this mean electric cars are exempt from taxes in the United States?

That’s what we’re here to look at. After all, EV owners need to know where they stand, tax-wise. But don’t worry, there is plenty of good news!

Let’s examine the tax on electric vehicles in the U.S.

Table of Contents

What Is Road Tax In The United States?

Road tax is easy to understand; it’s incurred for the use of public roads, which the government administers. Essentially, it’s a tax levied on motorized vehicles paid through registration fees, tolls, and the sale of cars.

Income collected from the above sources helps maintain public transportation infrastructure, among other things. These sources include a federal gasoline excise tax and annual EV registration fees.

It’s crucial for all EV owners, irrespective of the value of their vehicle, to know how and what they are paying to keep their cars on the road, especially nowadays.

In most of the U.S., EV users must pay a fee to use public roads. However, this is balanced out by the financial incentives associated with buying such a vehicle.

How Does Road Tax In The United States Work?

Registration Fees

In the United States, there is no federal road tax. Instead, each state collects fees in the form of annual registration fees. These differ from state to state and are based on vehicle age, weight, and value. EVs come in different weight categories and some are smaller than others.

Vehicle Safety Inspection

An annual vehicle safety inspection is also required in about half of all states; you can’t sell a car in most states without it passing this inspection.

Some of these funds may go to the State’s Road Fund.

Excise Tax on Gasoline

Another critical component of road tax in the United States is the sale of gasoline.

As in most countries, when you buy gasoline at the pump, some of your dollars go to the government. Federal excise tax on gas remains a constant at 18.4 cents a gallon in all states. But state excise tax on gasoline varies from state to state; that’s one reason gasoline prices differ nationwide.

These gasoline tax revenues are significant for the U.S.

A whopping $52 billion in revenue was raised from motor fuel taxes in 2019 alone. This revenue goes to maintaining and improving road infrastructure.

But what about EVs? They don’t use gasoline or diesel fuels but still use public road infrastructure.

This begs the question, do EVs in the US have to pay road tax?

Do I Have To Pay Electric Car Tax In The United States?

Yes and no. Luckily, electric car tax in the U.S is straightforward to understand.

According to the U.S Department Of Energy, over 320,000 plug-in electric vehicles (PEV) were sold in the U.S in 2019. As such, more EVs are using public roads, and the U.S government wants to levy a fee on these vehicles.

In most of the U.S, you’ll pay a registration fee for your EV, but not in every state; it depends on where you register your vehicle. Additionally, different types of EVs incur different fees.

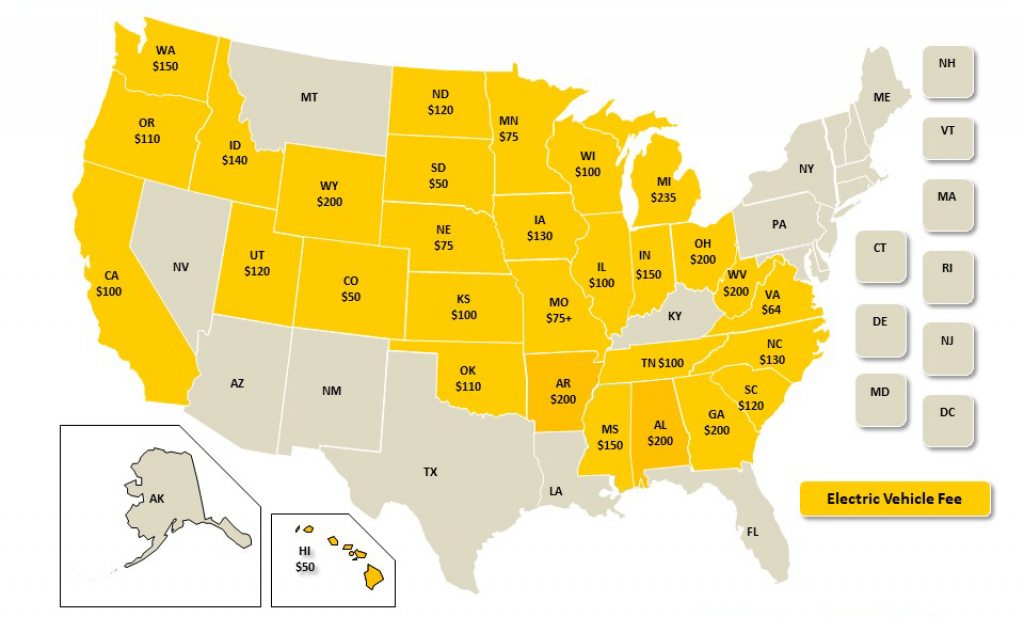

However, not all states charge EV users a road fee; currently, 30 states levy a fee on EVs.

Have a look at the map below to see if you have to pay a fee.

The United States Department of Transportation differentiates between two major types of EVs:

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Vehicles (PHEVs).

Since BEVs drive without fuel, their annual road fee is higher than that of PHEVs. Subsequently, no gasoline tax-based revenues can come from BEVs.

State-By-State Overview

While most states distinguish between BEVs and PHEVs, others do not; those states may use different criteria.

See the table below for a state-by-state overview of fees charged on your EV type.

| State | Fee |

|---|---|

| Alabama | $200 additional annual fee for battery electric vehicles (BEVs) $100 additional yearly fee for plug-in hybrid vehicles (PHEVs) |

| Arkansas | $200 additional annual fee for electric vehicles $100 additional annual fee for hybrid vehicles |

| California | $100 annual fee for a zero-emission vehicle, also known as a BEV |

| Colorado | $50 annual fee for “plug-in electric motor vehicle,” also known as BEV and PHEV |

| Georgia | $212.78 for non-commercial alternative fuelled vehicles ($200 base fee) |

| Hawaii | $50 annual surcharge for electric vehicles. |

| Idaho | $140 annual fee for electric vehicles, known as BEVs $75 yearly fee for PHEVs |

| Illinois | $100 additional annual fee for electric cars. |

| Indiana | $150 annual fee for electric vehicles, known as BEVs $50 annual fee for PHEVs and HEVs |

| Iowa | $65 additional yearly fee for battery electric vehicles (BEVs) $32 additional annual fee for plug-in hybrid electric motor vehicles (PHEVs) |

| Kansas | $100 total annual registration fee for all-electric cars. $50 total annual registration fee for electric hybrid and plug-in electric hybrid vehicles. |

| Michigan | $135 additional annual fee for “electric vehicles,” or BEVs, up to 8,000 pounds ($100 base fee) $47.50 additional annual fee for certain PHEVs up to 8,000 pounds ($30 base fee) |

| Minnesota | $75 annual fee for “non-hybrid electric vehicles,” or BEVs |

| Mississippi | $150 fee for electric vehicles $75 fee for hybrid vehicles |

| Missouri | $75 annual fee for alternative fuelled passenger motor vehicles $37.50 annual fee for PHEVs |

| Nebraska | $75 annual fee for alternative fuel vehicle |

| North Carolina | $130 additional annual fee for plug-in electric vehicles |

| North Dakota | $120 additional annual road use fee for electric vehicles. $50 additional annual road use fee for plug-in hybrid vehicles. |

| Ohio | $200 additional annual fee for plug-in electric motor vehicles. $100 additional annual fee for hybrid motor vehicles. |

| Oklahoma | Under 6000 lbs. (Class 1) – $110 |

| Oregon | $110 additional annual fee for electric vehicles |

| South Carolina | $120 biennial fee for vehicles operated exclusively by electricity, hydrogen, or any fuel other than motor fuel $60 biennial fee for hybrid vehicles |

| South Dakota | $50 annual fee at the time of registration of EV. This does not apply to hybrid vehicles |

| Tennessee | $100 annual fee for electric vehicles |

| Utah | $90 additional annual fee for electric motor vehicles. $39 additional annual fee for plug-in hybrid electric motor vehicles. $15 additional annual fee for hybrid electric motor vehicles. |

| Virginia | $64 annual license tax for alternative fuel vehicles or electric motor vehicles |

| Washington | $150 additional annual registration fee for electric vehicles $75 additional Hybrid Vehicle Transportation Electrification fee |

| West Virginia | $200 additional annual fee on electric vehicles $100 additional annual fee on hybrid electric motor vehicles |

| Wisconsin | $75 annual fee for hybrid electric vehicles $100 annual fee for nonhybrid electric vehicles |

| Wyoming | $200 total annual fee for plug-in electric vehicles. |

Are There Tax Incentives For Electric Cars In The United States?

Although you may have to pay an annual fee for your EV, there is good news — there are tax incentives for electric cars in the U.S.

This means that you could save thousands when buying your new EV. But what does it take to qualify for tax incentives on an electric car in the U.S?

Qualification Criteria

Qualifying for the credit isn’t difficult:

- Your vehicle must be a Battery Electric Vehicle (BEV) or a Plug-in Hybrid Vehicle (PHEV);

- It must be new or from after 2010;

- Have a minimum battery capacity of 4 kilowatt hours;

- Weigh less than 14000 pounds or roughly 6.3 tonnes ;

- Your vehicle should comply with emission standards;

- You must file this form with the IRS to receive benefits (also find information here for two-wheeled EVs).

For a detailed list of tax incentives for all BEVs and PHEVs in the United States, click here.

The Fine Print

Tax is never as simple as we’d like it to be. But don’t worry; if you’re a taxpayer in the U.S, you’ll be eligible for part of or the full tax break amount of up to $7,500 on your new EV.

Why? Because your total tax incentive amount relates to your income tax owed. Sound confusing? It’s not.

Let’s say you decide to buy an Audi e-Tron 50 Quattro. It starts at about $77,000, but it qualifies for a tax incentive of $7,500.

Let’s Lay Out 2 Scenarios:

- Scenario 1: you owe the U.S government, or the IRS, $8,000 in income tax. With the tax incentive on this model, you’d receive the $7,500 in tax credits and pay $69,500 for the Audi. Success!

- Scenario 2: you only owe the IRS $4,000 in income tax. Would you still get tax credits for the Audi? Yes, you would, but not the total $7,500; you get $4,000 in tax credits. You can now buy the Audi for $73,000. Not too shabby either!

If you’re a taxpayer in the United States and owe income tax, you also receive tax credits toward purchasing a vehicle from this list. The benefit you receive from that tax incentive is proportional to your income tax owed.

What Else Should You Know About Tax Incentives for EVs In The U.S.?

Even if you qualify for a tax incentive on an EV of up to $7,500, there are a few other things you should remember about taxes and EVs in the U.S.

Other Factors for Electric Car Tax in the U.S:

- Federal Tax Credits for EVs only go to the original owner; you cannot transfer them.

- Federal Tax Credits have a limited time frame. They may expire for your desired vehicle. In some cases, manufacturers lose eligibility for tax credits. To clarify, they produce too many cars, thus exceeding their benefit threshold.

- There is no limitation on how many EVs you can buy each year; you can still receive a tax incentive on each purchase. That is if your IRS owed income is large enough to support this. (See the above scenarios for clarification)

- For leased EVs, the tax credit goes to the lessor.

Some Sad News

Unfortunately for EV owners, a bill incentivizing tax credits for American-made EV batteries for up to $500 and American-assembled vehicles for up to $4,500 has recently been rescinded.

What Grants Exist For Electric Cars In The United States?

The United States is striving to power its economy with renewable energy. This transformation is also taking place in Europe and China — the transportation system is a significant part of this shift.

And it makes sense. According to the Environmental Protection Agency, transportation accounts for 27% of all GHG in the U.S. Transportation is the biggest emitter which is more significant than electricity production.

It makes sense that, that although there is electric car tax in the U.S, you’ll still pay less tax driving your EV.

It’s therefore, no surprise that President Biden wants to increase the electric vehicle sales share to 50% by 2030. There will be a lot of EVs on American roads in the future. The government does this by implementing consumer-facing tax incentives and grants.

These are for consumers and small businesses alike.

See the table below for a list of links and programs.

List Of Grants And Other Incentives For U.S. EV Owners

| Grants | Description |

|---|---|

| EV Miles Programme | $10 monthly credit for Concord residents who charge their EVs between 10 pm and 12 noon from Monday to Friday. |

| Other Tax Credits | $2,500 tax credit on the purchase of light-duty EVs in Colorado. Read more here. Reduced biennial vehicle registration fee of $57 in Connecticut. Read more here. |

| Time of Use Rates | Lower rates are charged to EV users during off-peak hours. Read more here. |

| Electric Charging Infrastructure Tax credits | Receive up to 30% tax credit or $30,000. for commercial electric vehicle supply equipment, infrastructure, and installation cost. Read more here. |

But it’s not only consumers and small businesses that get incentivized to switch to EVs; there are many other programs.

The government targets businesses to implement infrastructure projects for the government:

- The Zero-emission Vehicle Infrastructure Partnerships Grant is a $9.8 million funding opportunity to upgrade EV charging stations.

- Advanced Clean Car Program; another government program funding the development of environmentally advanced cars.

- The Improved Energy Technology Loans is another program. It provides grants for the development of alternative fuel vehicles.

The above examples comprise a short list of programs; there are many more.

As we approach climate and energy goals, this list of grant opportunities will only grow for everyone.

Final Thoughts

In summary, owning an EV doesn’t only come with obvious benefits. If you live in the right state in the US, the odds are high that you can make use of tax incentives to save on your next EV.

Electric car tax in the U.S is actually a good thing. It means EV technology is being adopted by the mainstream.

As such, things are looking up for the consumer in the ever-growing EV field.